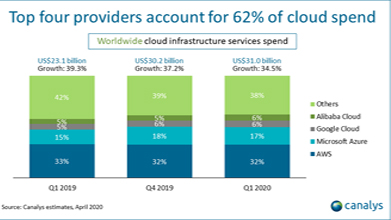

Q1 Global cloud infrastructure market share

Q1 Global cloud infrastructure market share: AWS 32% (US $ 9.92 billion), Microsoft 17% (US $ 5.27 billion), Google, Ali 6% each (US $ 1.895 billion)”

The COVID-19 has driven the digital gold rush: the four companies have a 62% market share.

As millions of employees moved work from office to home, cloud infrastructure providers began to make a fortune, and cloud service spending soared by 34.5% in the first quarter to US $ 31 billion.

The proliferation of online collaboration tools, e-commerce, and consumer cloud services has fueled this growth, but another result of governments ordering to stay at home is that complex enterprise migration projects have slowed down because the most other important tasks except IT tasks are suspended.

Alastair Edwards, principal analyst at Canalys, said: “This is an unknown area for cloud service providers, which promotes consumption but brings new and often challenging customer situations.”。”

“During this difficult period, the cloud has become a necessary tool to support business continuity. Many enterprise organizations use the bursting capabilities of the public cloud to respond to the sudden surge in usage. If there is no flexible solution provided by several major cloud providers, platforms like Zoom will not run properly. ”

In terms of supplier rankings, the Big Four divided 62% of the $ 31 billion spent by customers on cloud infrastructure during the quarter.

AWS won the top with 9.92 billion US dollars, soaring 33% year-on-year, accounting for 32% of the entire market.

Microsoft followed with 5.27 billion US dollars, soaring 59%, accounting for 17% of the market share, lower than 18% a year ago. Microsoft has admitted that Azure is facing capacity constraints, partly because Teams and Windows Virtual Desktop have been rapidly adopted, which has forced the company to restrict the consumption of some services and new customers.

Google Cloud and Alibaba Cloud tied for third place, both of which accounted for 6% ($ 1.859 billion). Google increased by 34.2% this year, Alibaba has increased by 61% while the market share of the two was 5% a year ago.

Canalys said that Google ’s data and analytics platform has driven demand in the public sector, healthcare, service providers, and financial services. Google also continues to hire sales and technical personnel.

” Microsoft is increasing server capacity in areas where its data centers are facing the greatest demand. AWS has opened data centers in Cape Town and Milan. Alibaba will spend $ 28 billion on its cloud business in the next three years.

Canalys principal analyst Matthew Ball stated that many companies were forced to readjust investment and IT infrastructure strategies “rapidly” this year.

As the global economy tends to weaken, it is imperative to reduce costs and protect capital. Faced with increasingly uncertain or difficult access to physical data centers, many companies have reconsidered budgets, so any local systems that cannot improve current business continuity plans have relegated to a secondary position.

At the same time, companies around the world urgently need to use flexible computing power to support remote office, collaboration, online commerce and security. Cloud infrastructure is the obvious short-term solution which benefits most major cloud service providers (even if not all cloud service providers).

Fiber Zip Technology provides high speed cables including SFP AOC, DAC cable for cloud infrastructure at different data rate per requirement.